Using BIR FORM 1700

(For Non-Business/Profession Income)

You are a regular employee but you find yourself needing to use Form 1700 for some reason. This guide will help you how to do that. April 15 is the deadline for filing taxes. Avoid the pila.

How to Accomplish BIR Form 1700 in 6 steps!

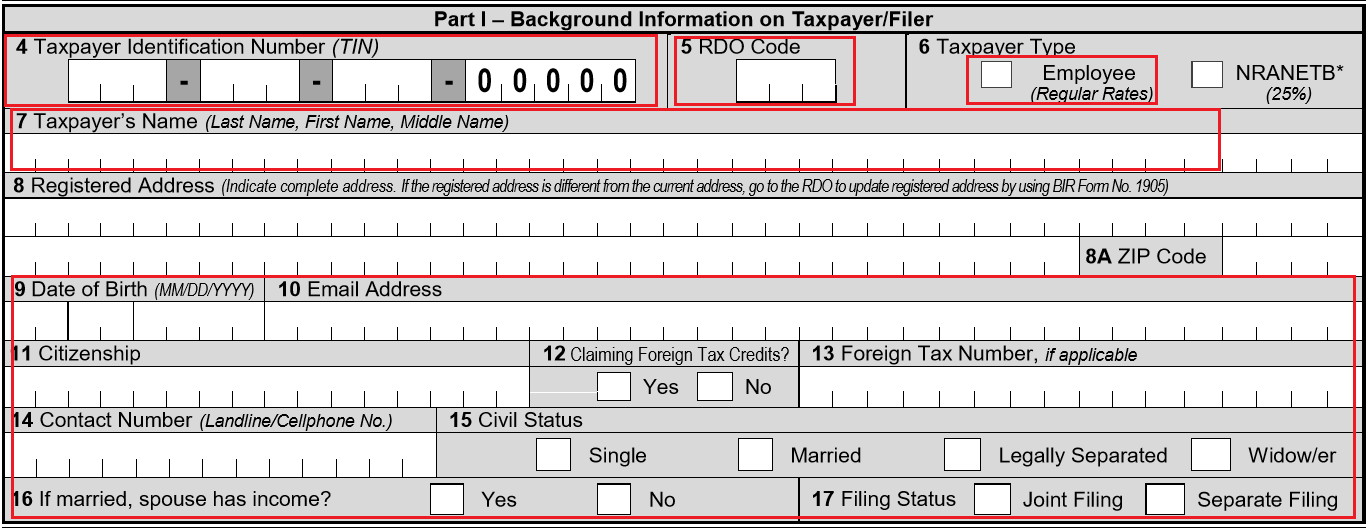

1. Part I - Background Information on Taxpayer

PreWork:

Download the latest BIR 1700 from their website.

Find out your RDO Code by calling BIR

You will fill out TIN and RDO and mark TAXPAYER Type = Employee with an ‘X’

If you’re an employee, your registered address will be that of your Employer so leave that blank.

Fill out other details such as date of birth, email address, citizenship, contact number, civil status etc.

2. Part II - Background Information on Spouse

Fill out this part if you are married.

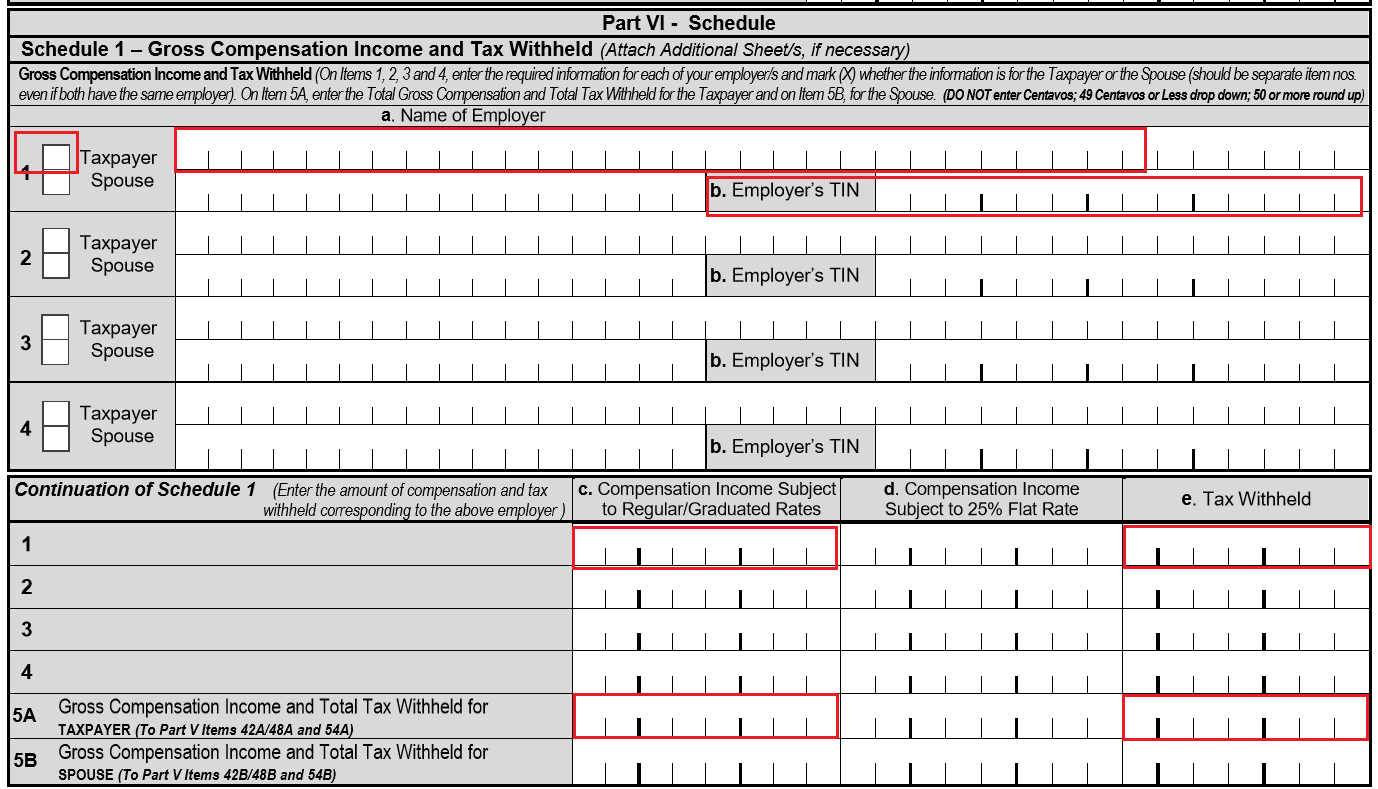

3. Part VI - Schedule

Yes, accomplish Part Six first and you’ll find out in a moment why.

PreWork:

Receive your BIR FORM 2316 from your Employer

Schedule 1 is Gross Compensation Income and Tax Withheld.

Fill out the ff:

On Item 1, Mark ‘X’ for TaxPayer and write down the Name of your Employer (Item 1a) and TIN (Item 1b)

On Item 1c, copy the Gross Compensation Income from your 2316 (item Part IV-A#21)

On Item 1e, copy the Total Amount of Taxes WithHeld from your 2316 (item Part IV-A#31)

On Item 5Ac and 5Ae, write the totals

4. Part V - Computation of Taxes

Yes, Part Five is next. You will copy some information you’ve already entered in Part Six.

Fill out the ff:

On Item 42A - Copy Gross Compensation Income from Schedule1 in Part VI

On Item 43 & 44- copy the Exempt Compensation from your 2316 (item Part IV-A#22 ) and compute Item 44 as instructed

On Item 45 - specify additional non-business/profession income and amount

On Item 46 & 47 - fill out as instructed

On Item 54 - Copy Tax Withheld per BIR 2316 from Schedule1 in Part VI

On Item 58 & 59 - fill out as instructed

5. Part III - Total Tax Payable

Finally, you’ll fill out this part. You will need information you entered in the previous step.

You will fill out the ff:

On Item 26, 27 & 28 - fill out as instructed

On Item 30, 35 and 36 - fill out as instructed

6. Part VI - Details of Payment

Prework:

Obtain the bank code of your chosen bank from the list of authorized banks of your RDO. Find out here. You can’t just go to any bank. Also, call them ahead of time if they are still authorize.

Determine what mode of payment you will use. If paying in check, be sure to use Manager’s Check. You can also use cash or bank debit.

Fill out the following:

On Item 38, write the bank code of the authorized agent bank, the date and amount.

Additional Info:

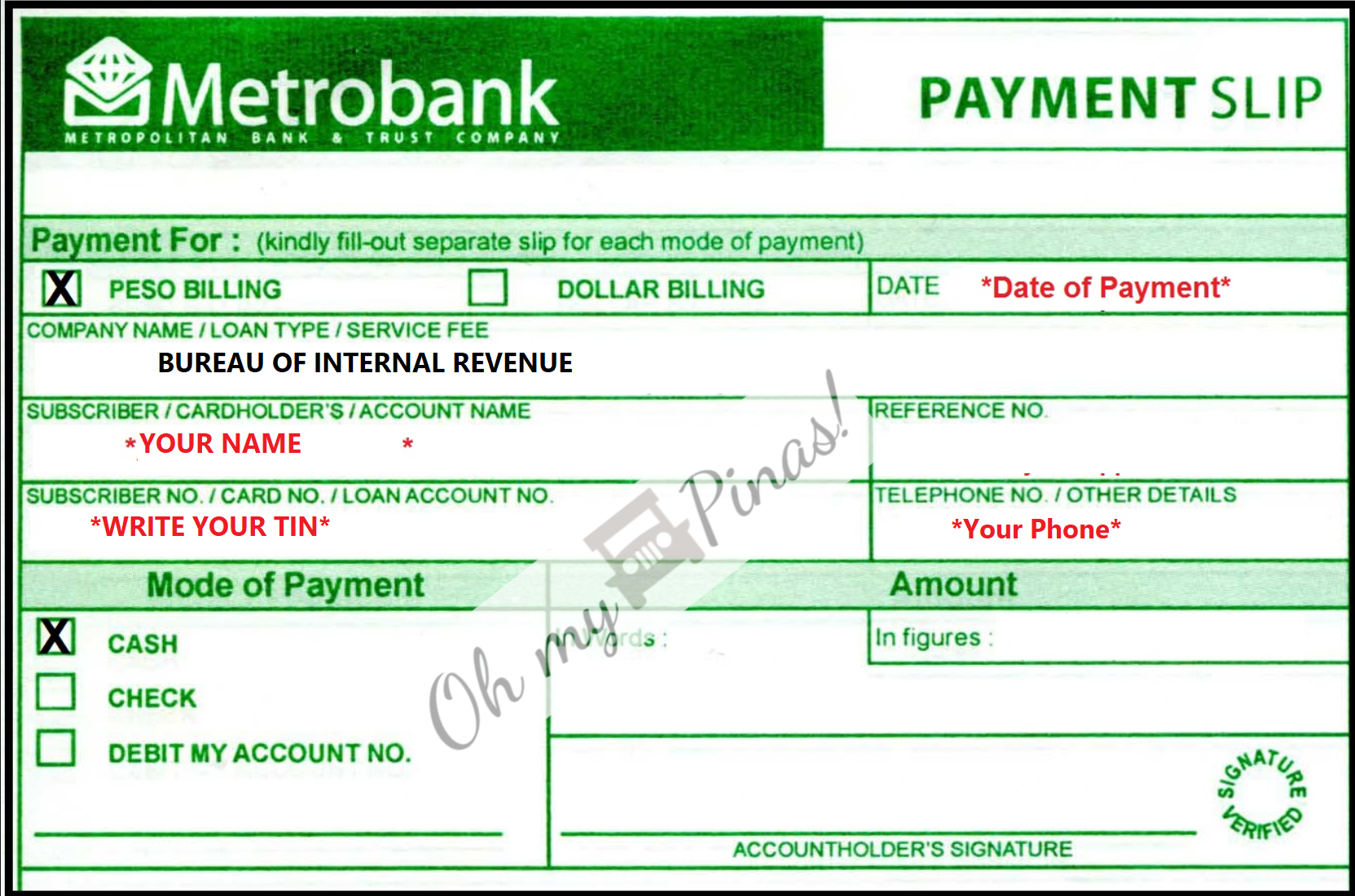

I paid my tax through Metrobank. Here are the steps.

Accomplish the BIR Form 1700 in triplicate.

Bring authorization letter (if needed) and Form 2316 as proofs of tax withheld.

Fill out Metrobank’s payment slip in triplicate. See image below. Remember to have this signed by the account holder if debiting from an account.