How I applied for Roche Patient Support Program

When my Dad was diagnosed with Non Hodgkin's Lymphoma, his oncologist said that he would have to undergo at least 6 cycles of Chemotherapy known as RCHOP. It is a combination of one Immunotherapy drug called Rituximab, 3 Chemo drugs and 1 steroid.

Rituximab or Mabthera is known to be a very expensive drug that can cost up to P100,000. Some people even go to India to buy it. With the 2-way plane fare and the drug, the cost is still cheaper. Can you imagine doing this for 6 times at least.

Rituximab is manufactured by Roche.

Thankfully, Roche has a program called Roche Patient Support Program (RPSP).

My Dad's oncologist gave him an enrollment form. The process is simple if you have carefully prepared all the documents. I didn't have to go through a personal appearance and a long queue.

Here are the steps to apply for the program.

Completely fill-up the following forms and email to rochepsp@zuelligpharma.com

a. Form 1 (Safeguarding Doctor-Patient Relationship and Confidentiality

b. Consent Form

These forms come with the Enrollment Kit we got from the doctor.

Roche will respond and ask for the following documents

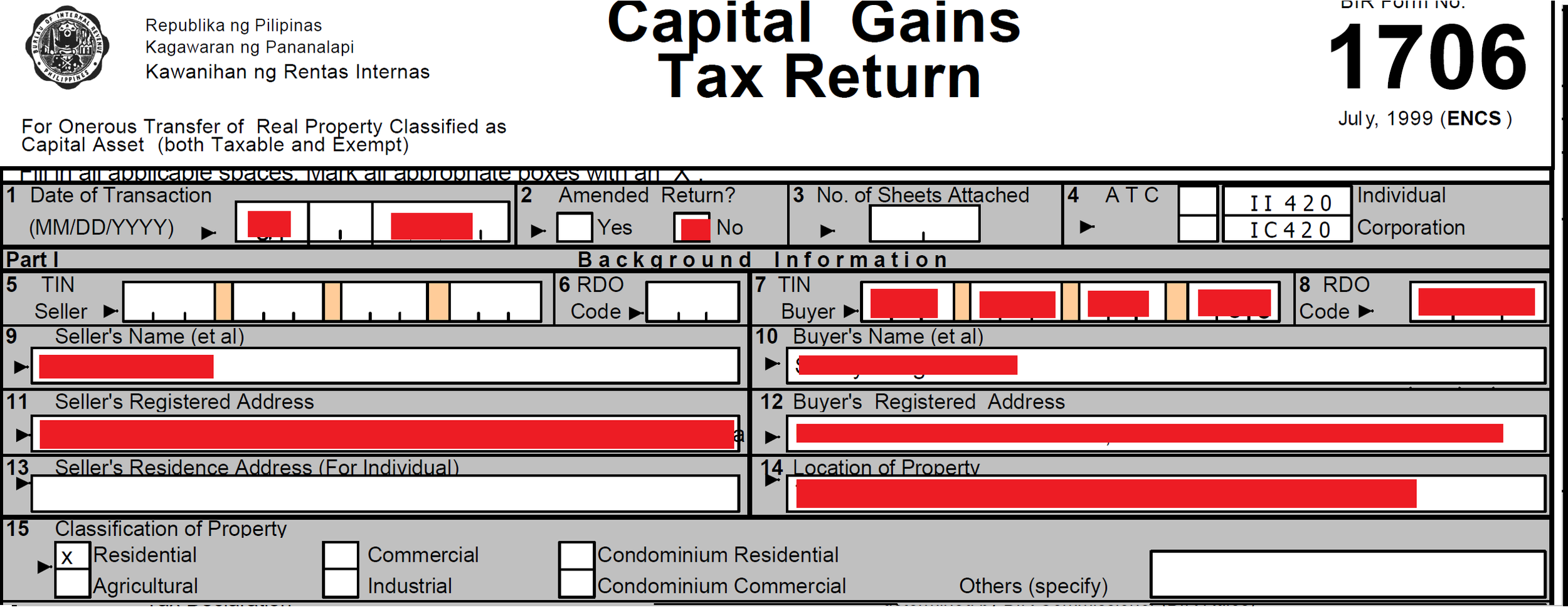

Financial Evaluation Form (also provided in the Enrollment Kit)

Financial Evaluation Supporting Documents. This can be any of the following:

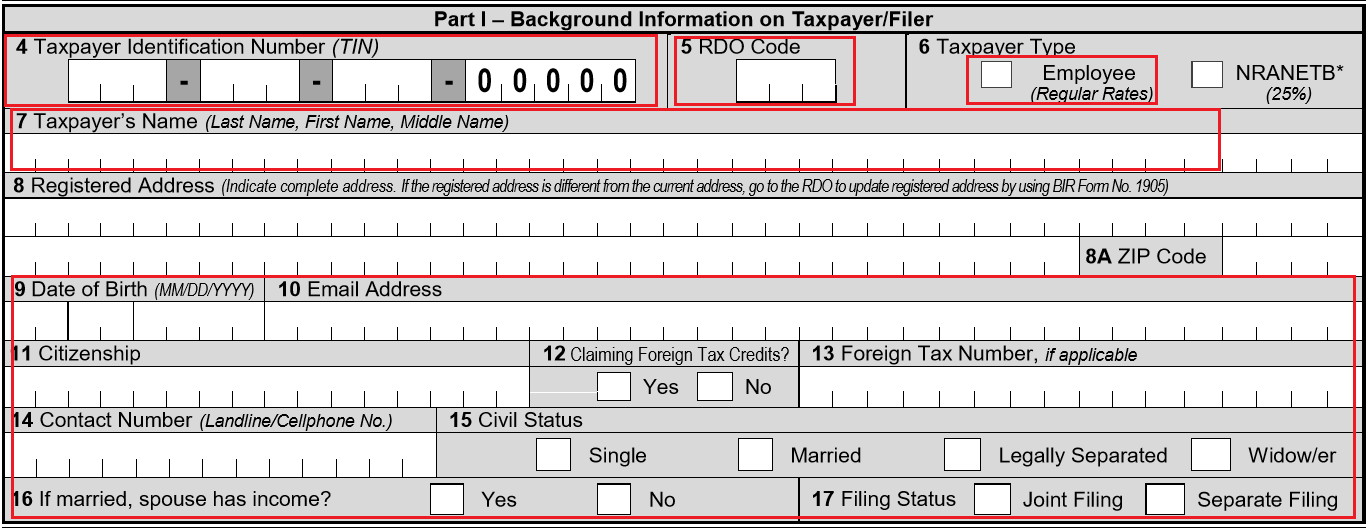

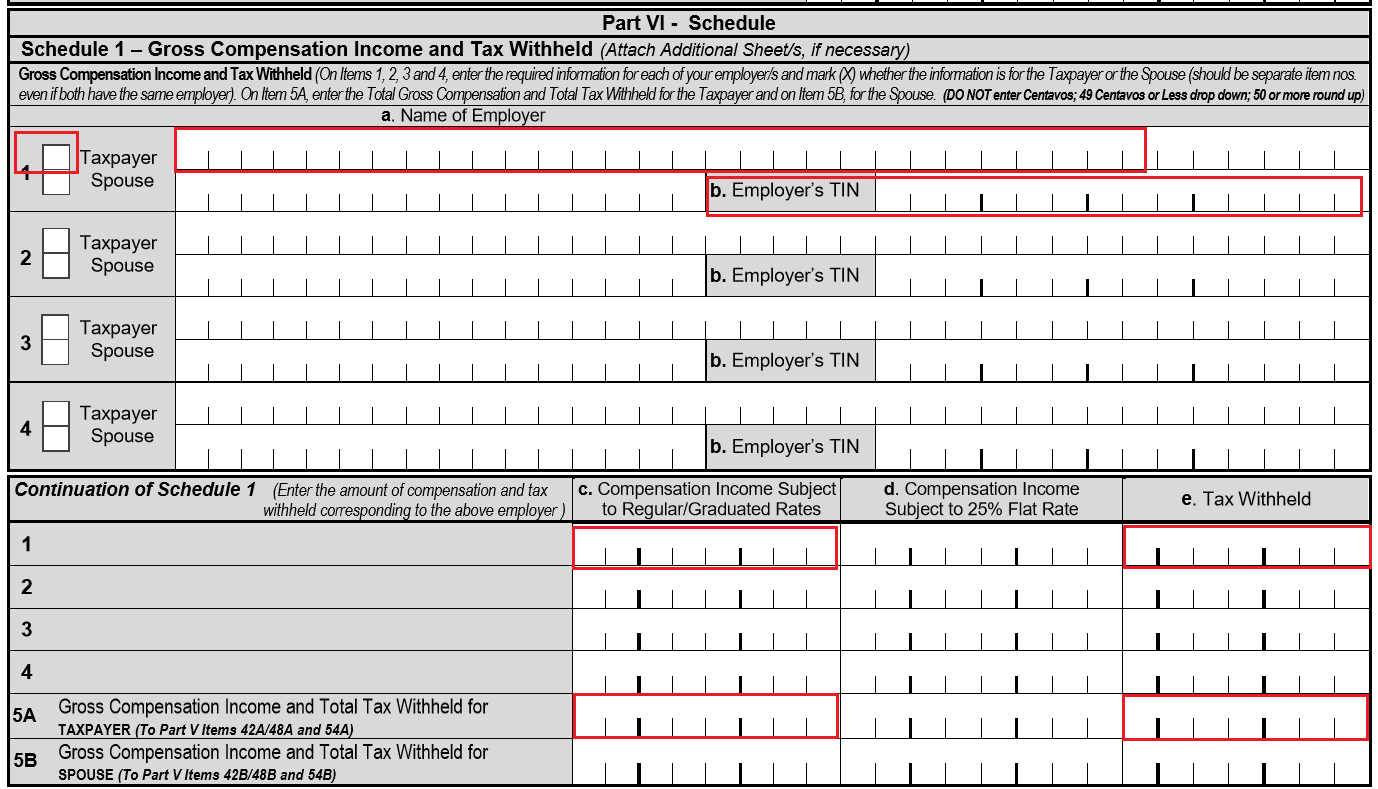

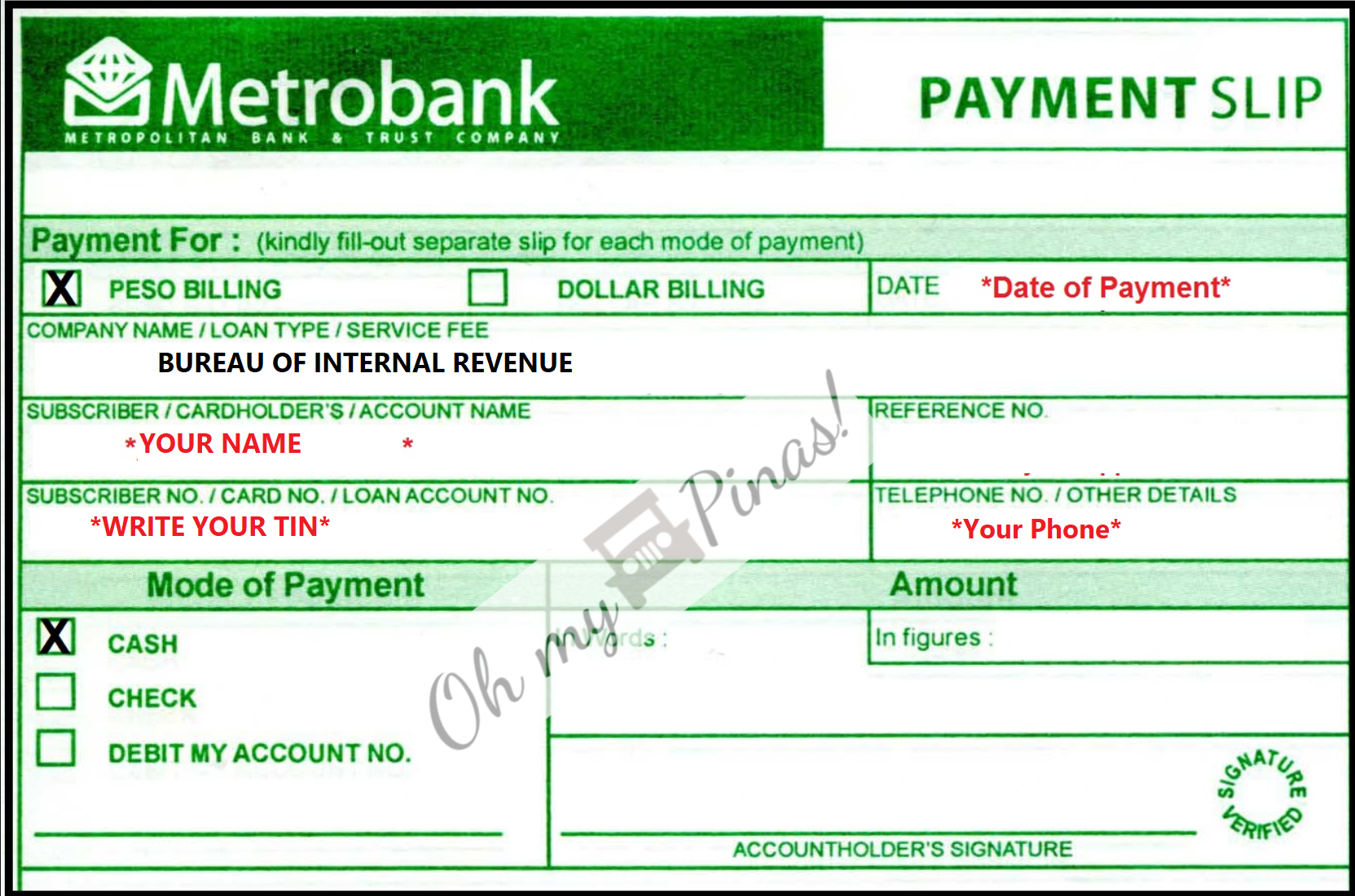

Latest ITR for each working member of the family

Certificate of employment for each working member of the family

Pay slips of each working member of the family

Certificate of Indigency from DSWD or Baranggay/City/Municipality if patient is indigent

Persons with Disability ID

Again, I only emailed these documents.

3. Roche will do a background check to verify the patient's condition and the supporting documents

In our experience, Roche called the patient/representative and the doctor to verify all documents are true.

4. Roche will contact you if your application is approved.

This is usually within 3 working days. Our application was approved for a duration of 1 year and with a discount of 40% for Rituximab per cycle.

5. Send Form 1 and Consent Form via Courier to

RPSP c/o Zuellig Pharmaceutical Corporation

KM 14 West Service Road,

South Superhighway cor. Edison Ave.

Brgy Sun Valley Paranaque City 1700

For every cycle of Chemo, I make a request by calling/texting Roche and provide the following:

Name of Patient

Infusion Date

Vial and Milligrams of Drug

Indicate whether for delivery or for pickup

We pick up our Rituximab at Globo Asiatico in UP Teacher's Village. You can also have it delivered to your home with no delivery charge if the total amount is at least Php 5000. You may ask the GloboAsiatico representative if your home address is covered and whether the delivery date is agreeable to you both.

We can’t stress enough our gratitude to Roche for giving us this generous discount. Especially now that applying in PCSO is quite a challenge.