Using BIR FORM 1706

(Capital Gains Tax Return)

You have just sold a property, Congratulations! Great. Now you need to do your part by paying your tax correctly. First comes the CGT or Capital Gains Tax.

As described by the BIR,

“Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale, exchange, or other disposition of capital assets located in the Philippines, including pacto de retro sales and other forms of conditional sale.”

Find all information from BIR regarding CGT here : https://www.bir.gov.ph/index.php/tax-information/capital-gains-tax.html

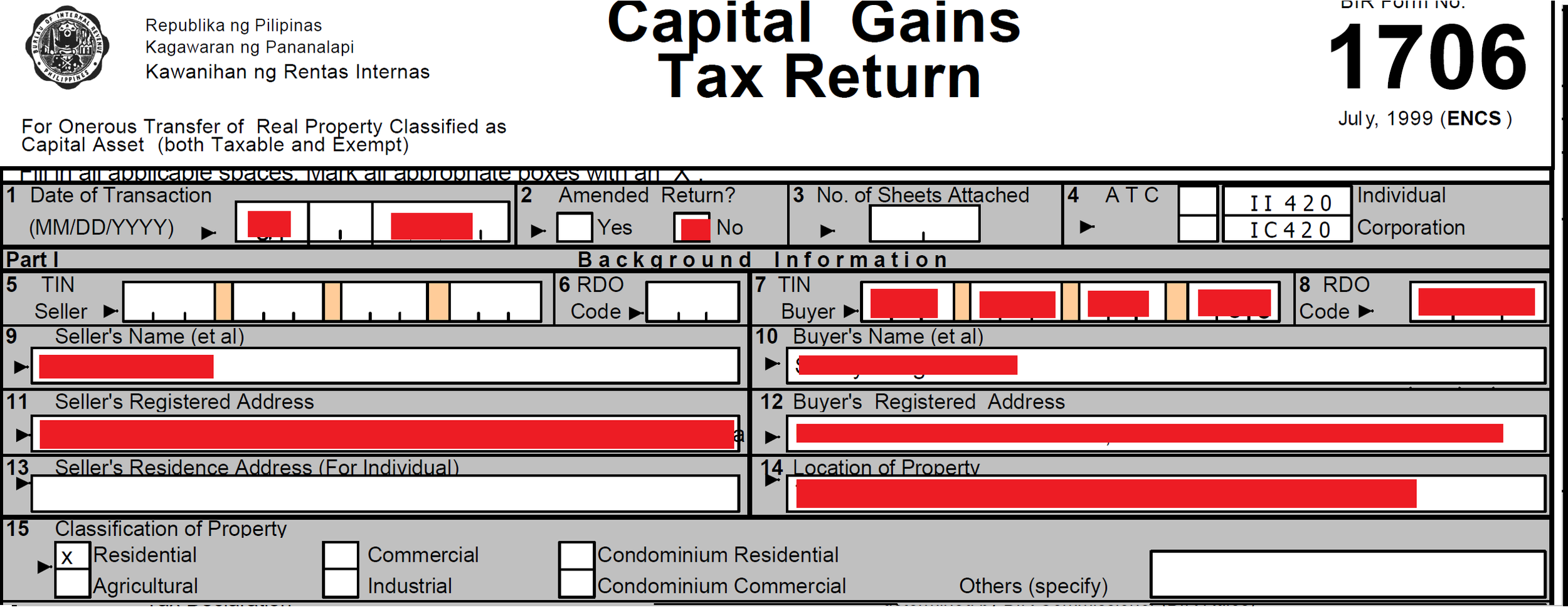

Below is an example of how I filled-out this form when I payed CGT for a land residential property.

How to Accomplish BIR Form 1700 in 4 steps!

PreWork

Make sure you have the following:

TIN of Seller/s and Buyer/s (Verified from BIR)

Notarized Deed of Absolute Sale (1) original copy and two (2) photocopies)

Certified True Copy of Tax Declaration for land and improvement (One (1) original copy and two (2) photocopies)

Certified True Copy of Original Transfer Title (OCT/TCT/CCT) (One (1) original copy and two (2) photocopies)

(Check https://www.bir.gov.ph/index.php/tax-information/capital-gains-tax.html for other requirements if what you are selling is not house and/or lot)

Download the latest BIR 1706 from their website. Accomplish in triplicate

1. Part 1 – Background Information

Info on the Parties and General Info on the Property

You will need to fill out the TIN & RDO of both BUYER and SELLER (You can find your RDO Code from BIR or you can also look at your past 2316 to get this)

Fill out Buyer and Seller's Name, Registered Address. You will also need to fill-out Seller's Residence Address.

Provide the Location of the Property and its Classification. (These can be found in the Tax Declaration)

2. Detailed Info on the Property

Fill out the following:

TCT No., area in sqm (refer to the TCT document) , Tax Declaration Number (TD No. in the Tax Declaration document)

Fields in 17-27 which are self-explanatory.

FMV Valuation of Land and Improvement (check the Tax Declaration Document)

FMV Valuation of Land and Improvement as per BIR Commissioner ( zonal value price multiplied to the area) . You can check the zonal values at https://www.bir.gov.ph/index.php/zonal-values.html

Gross Selling Price (as reflected in your Notarized Deed of Sale)

Final FMV – (computation reflected on the form)

3. Part II – Computation of Tax

Taxable Base: Whichever is higher between the gross selling price and the FMV

Tax Due: Taxable Base * .06

Tax Paid in Previous: (if for example paying in installment)

Tax Payable: Tax Due – deductions

Total Amount Payable

4. Part III - Details of Payment

If you choose to file the return with an AAB, obtain the bank code of your chosen bank from the list of authorized banks of your RDO. Find out here. You can’t just go to any bank. Also, call them ahead of time if they still authorize. Use the BIR-prescribed deposit slip. You can use cash or bank debit or check.

On Item 40, write the bank code of the authorized agent bank, check number if applicable, the date and amount. The AAB or Revenue Collection Officer of RDO shall stamp the return.